After the interest on tax prepayments was raised significantly in 2024, it is to be lowered again in 2025.

If you pay your taxes at the beginning of the year instead of the end, or if you pay more tax than necessary, you will receive compensatory interest. The interest is usually shown on the final tax bill and deducted from the tax burden. However, if you pay your taxes later or make too low advance tax payments, you may incur negative compensatory interest in certain cantons.

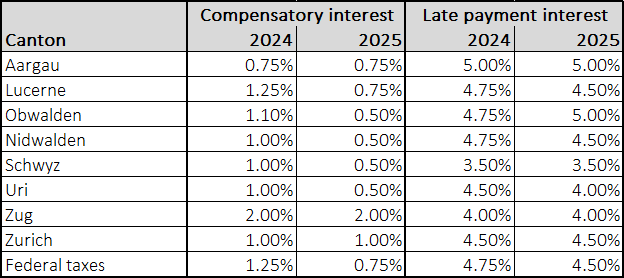

After compensatory interest on tax prepayments was introduced in most cantons in 2024, the interest will be adjusted to the current interest rate level in 2025 and significantly reduced again.

Interest on late tax payments will remain high, which is why it is still highly advisable to pay tax bills on time.

The following table will help you to decide whether prepayments are advantageous in your case:

We will be happy to advise you on this and help you calculate your tax liability.

+41 41 226 30 55

This email address is being protected from spambots. You need JavaScript enabled to view it.